Paul B Insurance Things To Know Before You Get This

Wiki Article

Not known Factual Statements About Paul B Insurance

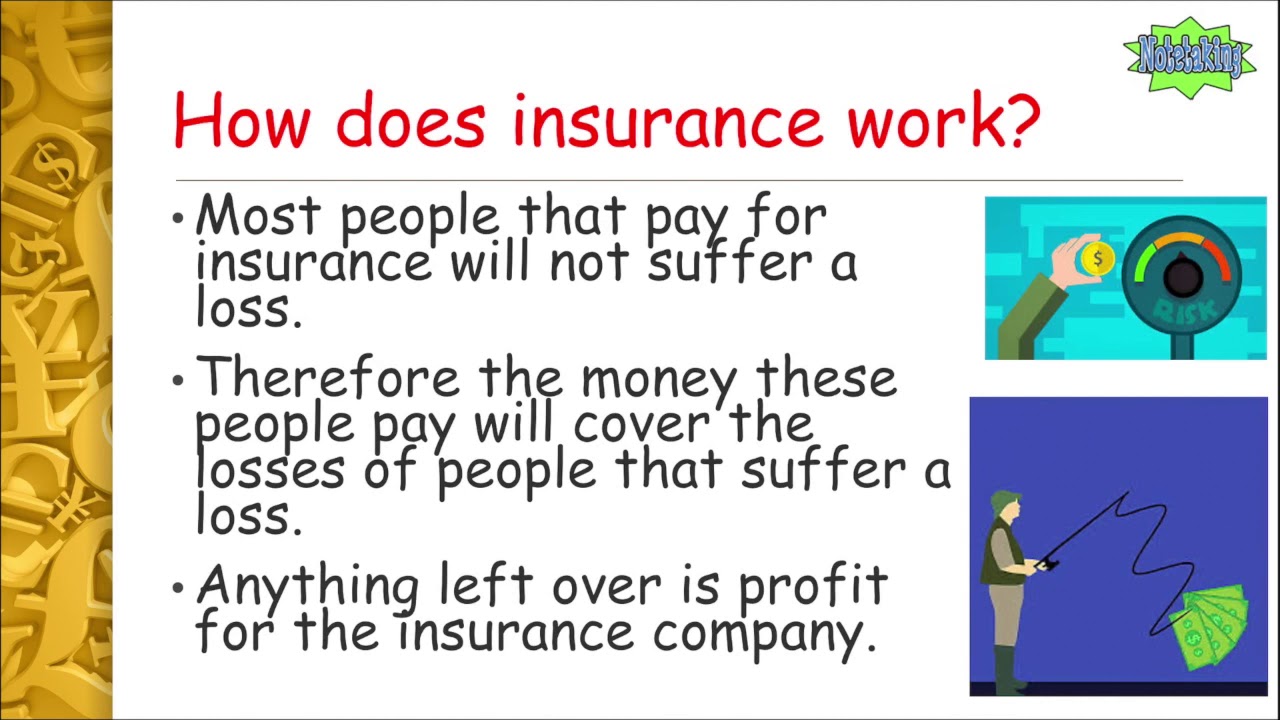

The idea is that the cash paid in insurance claims in time will certainly be less than the total costs accumulated. You might seem like you're throwing money gone if you never sue, however having piece of mind that you're covered on the occasion that you do suffer a significant loss, can be worth its weight in gold.

Picture you pay $500 a year to guarantee your $200,000 house. This means you have actually paid $5,000 for home insurance policy.

Since insurance is based upon spreading the danger among lots of people, it is the pooled cash of all people spending for it that permits the business to construct properties and also cover insurance claims when they take place. Insurance coverage is a business. It would certainly be wonderful for the companies to simply leave prices at the same level all the time, the fact is that they have to make enough money to cover all the potential insurance claims their insurance holders may make.

The Buzz on Paul B Insurance

Underwriting modifications as well as rate increases or decreases are based on results the insurance coverage business had in past years. They sell insurance from just one firm.

The frontline people you deal with when you acquire your insurance coverage are the agents as well as brokers who stand for the insurance firm. They a familiar with that firm's products or offerings, however can not speak towards various other business' plans, pricing, or item offerings.

They will certainly have access to more than one firm as well as must find out about the variety of products offered by all the firms they represent. There are a couple of essential questions you can ask on your own that might help you choose what kind of insurance coverage you need. Just how much danger or loss of cash can you presume by yourself? Do you have the cash to cover your costs or financial debts if you have a mishap? What concerning if your house or car is spoiled? Do you have the cost savings to cover you if you can not work because of an accident or health problem? Can you afford higher deductibles in order to reduce your expenses? Do you have unique requirements in your life that call for extra protection? What problems you most? Policies can be customized to your needs as well as recognize what you are most concerned concerning protecting.

Paul B Insurance - Truths

The insurance coverage you need differs based upon where you go to in your life, what sort of assets you have, and what your long-term objectives and also duties are. That's why it is vital to put in the time to review what you desire out of your plan with your representative.

If you secure a loan to acquire an automobile, as well as then something happens to the vehicle, gap insurance will certainly pay off any section of your loan that standard vehicle insurance policy does not cover. Some loan providers require their borrowers to lug void insurance coverage.

The primary function of life insurance is to give cash for your beneficiaries when you pass away. Depending on the type of plan you have, life insurance coverage can cover: Natural deaths.

Paul B Insurance - An Overview

Life insurance coverage covers the life of the insured individual. The insurance policy holder, that can be a different individual or entity from the insured, pays costs to an insurer. In return, the insurance company pays out an amount of money to the beneficiaries listed on the policy. Term life insurance policy covers you for an amount of time picked at acquisition, such as 10, 20 or thirty years.

Term life is popular since it uses huge payments at a reduced price than permanent life. There are some variations of normal term life insurance policies.

Long-term life insurance policy plans develop money value as they age. A part of the premium repayments is included to the money worth, which can make rate of interest. The money value of whole life insurance coverage policies over at this website grows at a fixed rate, while the cash worth within global plans can fluctuate. he said You can use the cash worth of your life insurance policy while you're still alive.

Things about Paul B Insurance

$500,000 of entire life coverage for a healthy 30-year-old female expenses around $4,015 each year, on average. That very same level of protection with a 20-year term life plan would cost a standard of about $188 yearly, according to Quotacy, a broker agent firm.

check my blog

Nonetheless, those investments come with even more threat. Variable life is another long-term life insurance policy option. It seems a whole lot like variable global life but is really different. It's a different to whole life with a fixed payout. Nonetheless, policyholders can use investment subaccounts to grow the money worth of the policy.

Here are some life insurance policy fundamentals to assist you better comprehend just how coverage works. Costs are the settlements you make to the insurer. For term life policies, these cover the price of your insurance policy and also management prices. With an irreversible plan, you'll additionally have the ability to pay money into a cash-value account.

Report this wiki page